Last week, The Lyst Index issued the top 20 brands for Q3, so let’s unpack it.

My personal highlights:

Alaïa went up 12 places

Balenciaga dropped by 10

The Row went up 7 places

Chloe entered the ranking

Alaïa

Ever since the moment Pieter Mulier joined Alaïa, I knew we were in for a treat. He is the first creative director of the maison apart from Azzedine Alaïa himself, who was deeply beloved in the industry and revered for his craftsmanship. Stepping into a role like this could easily be intimidating, as it means following in the footsteps of one of fashion’s most celebrated designers. Seven seasons in, it’s undeniable that Pieter is becoming one of the most admired designers of our time.

In my Autumn Favourites article I shared a podcast interview with Pieter where he tells Vogue that when Alaïa initially released their mesh ballerina shoe, they sold only 60 pairs that year. Pieter believed in the design, so he brought it back the next year - and sold 120 pairs. This didn’t stop his belief in the design and luckily Alaïa’s CEO trusted him, so after he presented the shoe for a third year in a row, it hit incredible highs. From fast to high fashion brands, everyone wanted to create their own take on this style and it became the most copied ballerina design! The Alaïa ballet flat is also the most popular product for the quarter. That very much resembles their journey on the The Lyst Index - they weren’t even part of it in 2023, only to join in Q1 this year and go from N19 to N5 in 9 months!

I guess what customers really appreciate is the effortlessness with which Pieter recognises and respects Alaïa’s history but makes it his own at same time. Each collection builds seamlessly on the previous one, and the house manages to keep its shows intimate despite growing global interest. One of their Spring/Summer campaign images is even my lock screen - I’m fully here for their rise. I look forward to seeing them climb even higher in the final quarter of the year.

Balenciaga

To create a positive sandwich effect, let me quickly mention the decrease of interest for Balenciaga. With this brand, you never know how long the customer will avoid them, but I’m glad to see decrease in interest. In July, they launched an Apple Vision Pro app - a decision that feels heavily sales-driven to me—but it didn’t seem to have much impact, as their sales dropped 14% in Q3.

For their SS25 show, Demna has said “the time has come for fashion to have a point of view” - well, I couldn’t see it and maybe others struggled as well considreing their ten-place drop in the rankings.

The Row

Despite being incredibly private, Mary-Kate and Ashley Olsen remain endlessly interesting to the public. They launched their brand, The Row, almost 20 years ago, yet it remains one of the most popular labels with everyone talking about their perfectly tailored garments. At times, their prices are inexplicable - flip flops for £630? I’m not sure that even they can justify that price point but there you go, people are loving it. Amy Odell wrote in her Substack “Can the Olsens Make The Row the Next Hermès?” and with the increasing difficulty of shopping in Hermès, it seems entirely plausible.

The Row recently received investments valuing the brand at $1 billion. The investors include prominent families behind Chanel (Mousse Partners) and L’Oréal (Tethys), as well as Natalie Massenet’s Imaginary Ventures and St. Dominque Capital, Moda Operandi’s co-founder private fund.

A whole case study could be done on The Row. What began as a celebrity clothing brand has evolved into a serious player targeting ultra-high-net-worth individuals. “If you’re collecting $3000 sweaters, fluctuations in the economy probably aren’t going to affect your discretionary income very much.”

They also recently opened their 5th boutique, this time in Paris.

Chloé

As Chemena Kamali says, “boho style isn’t a trend.” Celebrities like Sienna Miler are a prime example for this - boho-chic is a way of dressing but also a way of living. After Chemena’s debut collection last spring, a ton of articles surfaced with headlines such as “Boho is back: Chloé show marks revival of hippy-adjacent style”; “Did Chloé Just Bring Back Boho-Chic?” and “Boho Chic Is Back. Again. How Did We Get Here?”

Chemena Kamali’s work at Chloé truly resonates with a specific customer: the busy woman who’s always on the go but wants to look effortlessly chic. Her second collection was just as successful as the first, securing her a spot in The Lyst Index. I’m very happy to see that as Chemena Kamali has quickly become one of my favorite new designers.

More from The Lyst Index

There has been a 109% increase in searches for contemporary brands which take over the interest away from high fashion.

In August, Oasis announced their reunion tour, and it’s interesting to note that the Clarks Wallabee - favored by Liam Gallagher, who also collaborated with them - has made it into the top 10 products for the quarter. Also, Stone Island saw a 28% increase in demand this quarter, thanks to a new campaign featuring Liam Gallagher. It’s always fascinating and exciting to see the influence of music on fashion.

Etcetera

The Victoria's Secret show has come and gone. I remember the show’s impact years ago and the anticipation before the event, the amazement that followed... For their comeback they’ve decided to keep budgets low (have you seen the BTS photos? no fantasy bra?) and the engagement has reflected that. No one was amazed, no one is likely to remember it. I also wonder if the amount of incredible fashion shows we have now makes it harder to create a memorable show. How challenging must it be to create a show to rememeber!

Vogue announced next year’s Met Gala theme - Superfine: Tailoring Black Style which will highlight the impact and influence of the Black Dandy in fashion.

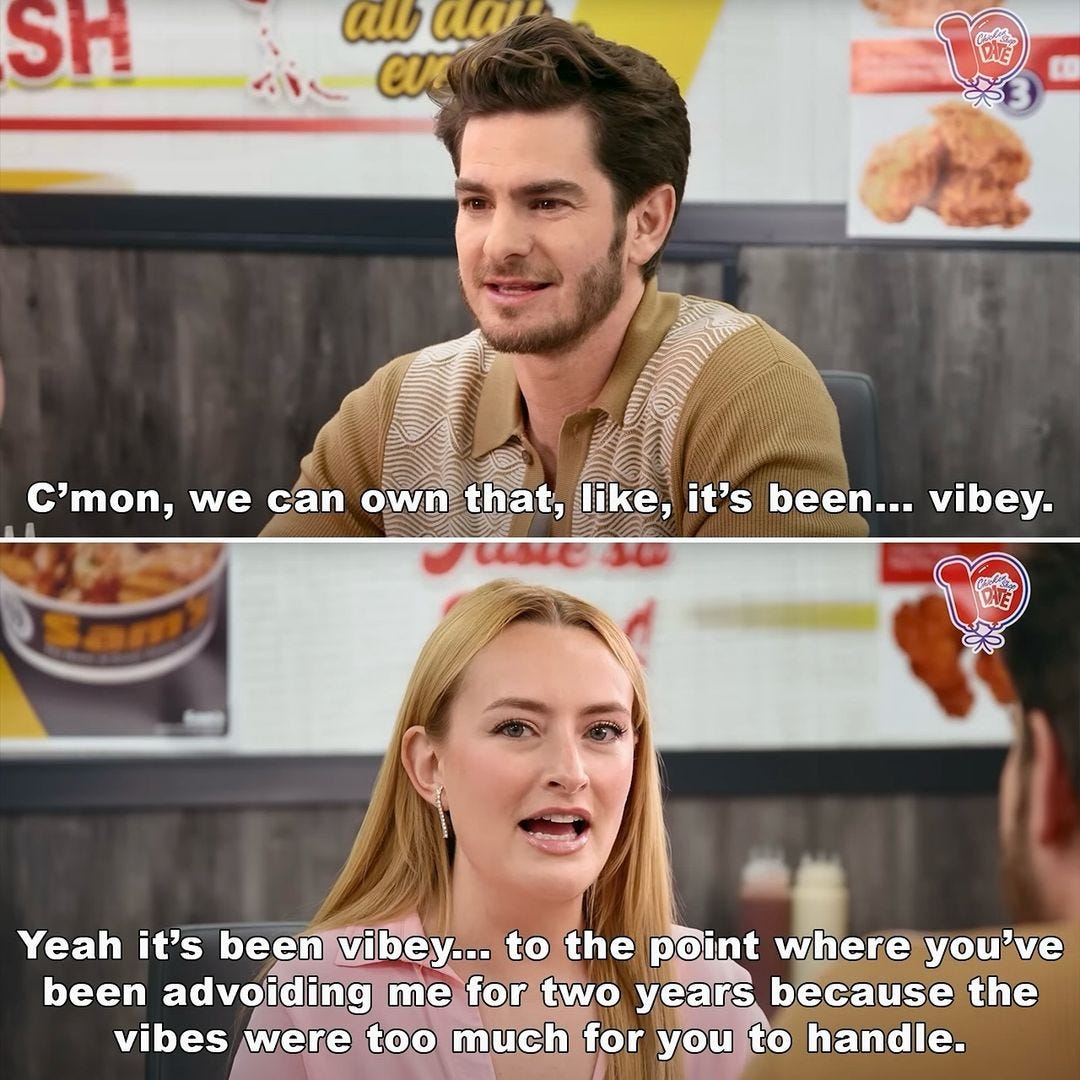

Amelia Dimoldenberg sat down for her latest Chicken Shop Date with Andrew Garfield. It was highly anticipated and certainly did not disappoint. The New York Times have also reported on the subject timelining Amelia and Andrew’s encounters.

Love the article! Very surprised by Gucci moving 2 places given their weak performance.